Not long ago, Teva Pharmaceuticals was considered a poster child for problematic M&A following the $40 billion acquisition of Allergan’s generics unit Actavis in 2016, which led to Teva cutting a quarter of its workforce in a major restructuring. Now, after almost a decade of cost-cutting and soul-searching, the Israeli drugmaker may have finally turned the page.

Known for more than a century as a generics maker, the company has dabbled in innovative medicines since the approval of the multiple sclerosis treatment Copaxone in the 1990s. Now, new drug development is a priority for Teva, said Dr. Eric Hughes, chief medical officer and executive vice president of global R&D — and a portfolio of marketed products as well as a humming pipeline reflect that mindset change.

“The amount of transformation the R&D organization has gone through at Teva over the last few years has been exciting,” Hughes said. “It’s not a matter of if we’re going to grow, but about how much we’re going to grow into the future.”

While Copaxone has faced generic competition of its own, along with accusations of antitrust behavior from Teva, the company has revved up its R&D engine to produce newer drugs like the Huntington’s disease treatment Austedo and the migraine therapy Ajovy, which have brought growth and a renewed sense of purpose outside of the company’s copycat bread and butter. Teva is now on a hot streak with 10 quarters of consecutive growth, Hughes said.

"We needed to stop thinking about slowing things down and cutting costs, and more about how we accelerate and strategically apply capital to move forward."

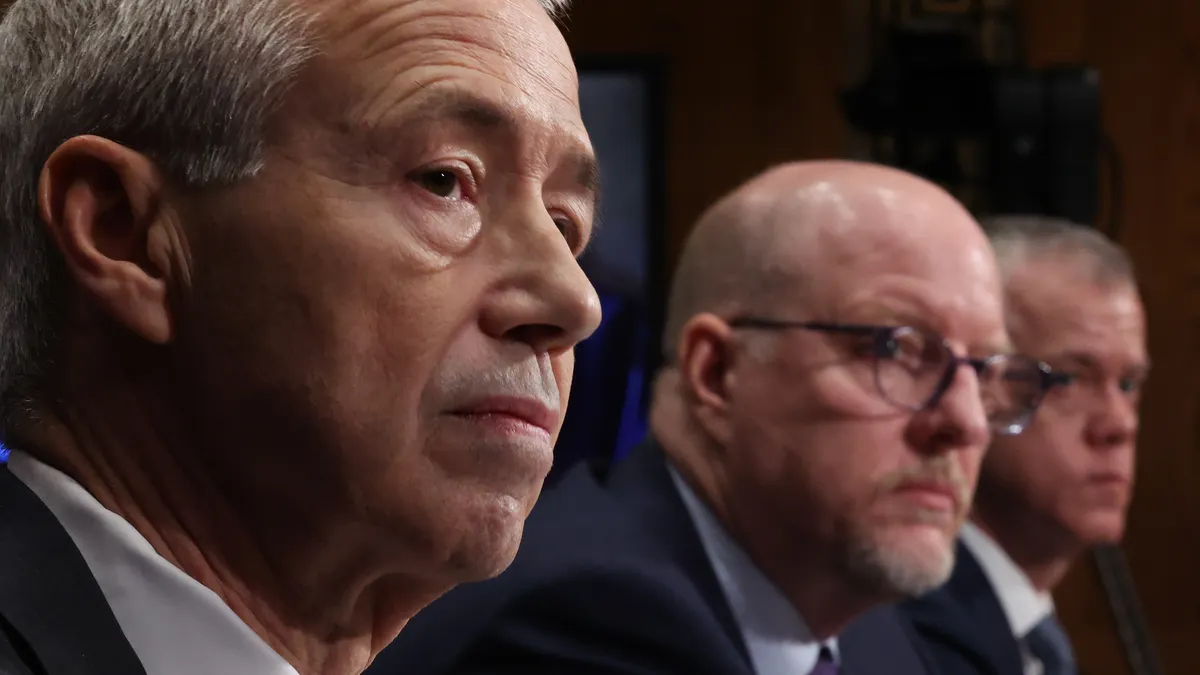

Dr. Eric Hughes

Chief medical officer, EVP, global R&D, Teva Pharmaceuticals

The pipeline is even more of a bright spot, Hughes said. Candidates like the late-stage-ready immunology “pipeline-in-a-product” duvakitug, partnered with Sanofi, as well as mid-stage candidates such as multiple system atrophy treatment emrusolmin and celiac disease drug TEV-53408 comprise a promising lineup.

Here, Hughes describes Teva’s strategy to turn the ship around during an especially difficult time, change the approach from generics to innovative medicine and overcome the challenges faced by the industry overall.

This interview has been edited for brevity and style.

PHARMAVOICE: Tell me about the kinds of strategic conversations you had in the lead-up to rebuilding Teva.

DR. ERIC HUGHES: The ‘pivot to growth’ strategy started about three years ago when Richard Francis came on as our CEO, and I had gotten there about six months before that. The strategy was to focus on returning the company to growth with four simple pillars. One was to lean into our in-market brands. Second was to lean into innovation. Third was to maintain our powerhouse in generics. The fourth was to focus the business.

I was especially excited about the second pillar because leaning into the innovative abilities and pipeline is the main way we want to grow the company. Building on this foundation of generics, we could develop a modern drug development matrix and build on those synergies.

That phrase, the “modern drug development matrix” — what does that mean for Teva in particular?

Having been at a lot of Big Pharma companies over my career, I became a student of how organizations are structured, and how they build a culture and mindset around engaging with that structure. Drug development is a complex process that requires multiple disciplines and different expertise, and that’s why you have to have a matrix with strategic leadership and equal functions contributing to that. When I got to Teva, that was very fragmented, yet the company had a fantastic culture to build upon.

The important thing about setting this up was that there’s a surprising amount you can take from generics and biosimilars and apply to innovation, and vice versa.

What are some of the lessons you take from generics that apply to the pursuit of innovative medicines, from Teva’s first approval of Copaxone to today’s bigger R&D engine?

We’ve always had a kernel of innovation in our DNA at Teva. It’s not a totally new concept, and even through our generics history, we make great formulations. I never have trouble getting expertise when it comes to developing a formulation, either novel or one of the over 500 generic products used in the U.S. every day. I feel sometimes like the innovative group at Teva is like a biotech with the resources and funding of Big Pharma.

This transition is more than just revving up the R&D engine and getting products to market. Tell me more about changing the company’s mindset, as you said, to pivot toward new medicines.

Organizational structure needs a culture mindset to drive it — boxes on a chart are not what develop drugs. The people and the culture behind it are most important. To execute, you have to develop a culture of inclusiveness, of listening, of inspiration, because one of the advantages we have at Teva is we’ve been through a lot of challenges. After the bad Actavis deal, they were in survival mode for many years. But as we came out of that, we needed to stop thinking about slowing things down and cutting costs, and more about how we accelerate and strategically apply capital to move forward.

Now, Teva has seen 10 quarters of consecutive growth. To what do you attribute that turnaround from the thornier times before?

That’s the result of every group at Teva, and especially the commercial team with [Huntington’s disease therapy] Austedo and [migraine treatment] Ajovy. [CEO Francis] would be the first person to say we have a very strong commercial footprint and a sort of mojo with the people we’ve brought on and what we’ve been able to execute. Generics is so big we can continue [to be] that powerhouse because we’ve done it all before, and now we’re making the R&D complex more efficient and finding efficiencies in technical operations.

What are some of the challenges you face now that you’ve made that pivot?

We have such a strong pipeline, and bringing it forward as quickly as possible with the resources we have is my biggest challenge, focusing on three phase 3 programs and two very good phase 2 programs. Another challenge is forming partnerships in the innovative space. Teva has a broad history of partnerships in generics, and people don’t realize how important that is — and partnering in the innovative space is a new process for them.

Teva always had a great culture, but it also had a burning platform three years ago where they knew they had to change. They had not been growing, and they were looking for some hope at that point. But if you have the baseline mindset of a willingness and a desire to change, that’s the first step. What are we doing to make this industry better and bring drugs forward? We’re cutting timelines and thinking more actively about how to do this efficiently.

Beyond Teva, how would you characterize the era that the pharma industry is in currently?

The industry has been challenged by the fact that things are getting more expensive and timelines are getting longer. But although regulations are getting a little stricter, we have to follow them, and we have to be more focused on how we do that. The way Teva is approaching it is to stay focused on the therapeutic areas of neuroscience and immunology, making sure we increase our probability of success, shortening those timelines and getting to the value more rapidly.