Hear that low rumble in the distance? That’s a locomotive loaded with biosimilars headed straight for Merck & Co.’s flagship cancer med Keytruda, bringing direct competition to where the megablockbuster now stands as a formidable pillar in oncology.

But Merck is no victim tied to the railroad tracks — the pharma giant has a plan, and Tuesday’s launch of Keytruda’s subcutaneous version following regulatory approval last month has them heading in the right direction, according to consensus forecasts from Evaluate.

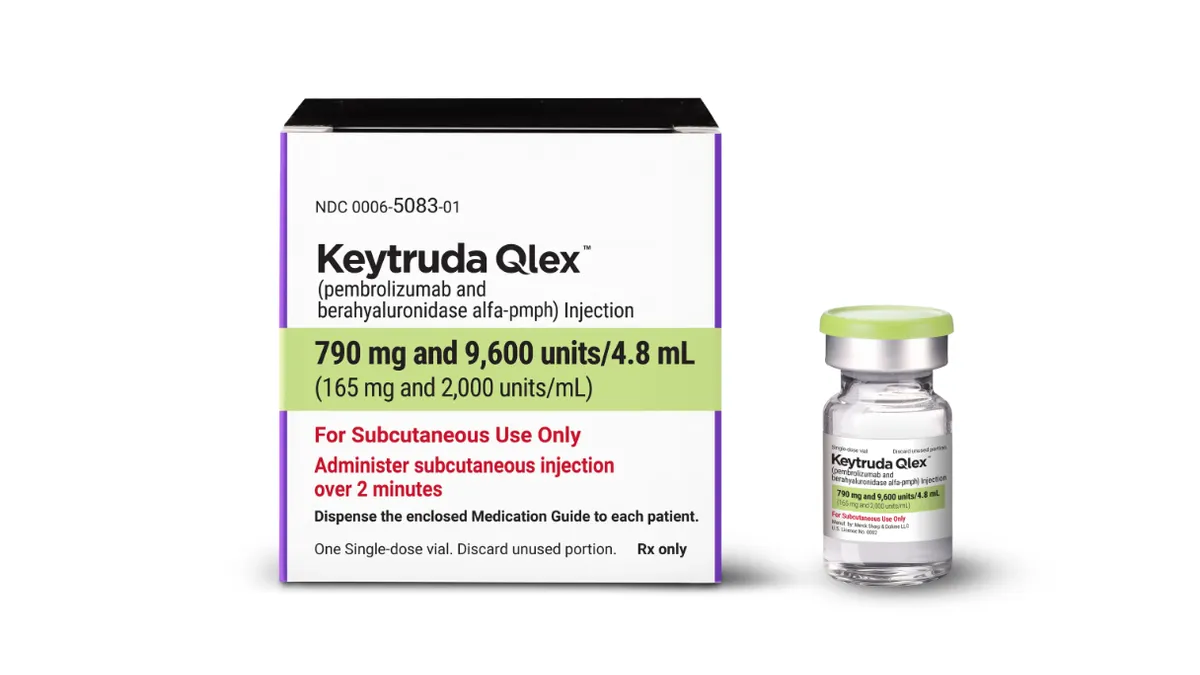

Delivered under the skin in one or two minutes — as opposed to a half-hour infusion — Keytruda Qlex is expected to gain traction quickly, although not nearly as fast as the original’s pending decline. Qlex has been approved for 38 of the solid tumor indications addressed by the original.

Keytruda pulled in almost $29.5 billion as the bestselling drug in the world in 2024, representing almost half of Merck’s total sales. With an expected sales peak at almost $32.7 billion next year, according to Evaluate, the drug still has legs.

But by 2027, the downhill slide will begin. After a shallow impact at first, sales estimates will dwindle to just over $7 billion by 2032, according to Wall Street’s consensus.

Merck's Keytruda consensus forecast, in $M

| Keytruda | Keytruda Qlex | Total | |

|---|---|---|---|

| 2024 | 29,482 | 0 | 29,482 |

| 2025 | 31,503 | 34 | 31,537 |

| 2026 | 32,676 | 896 | 33,572 |

| 2027 | 32,560 | 2,859 | 35,419 |

| 2028 | 28,474 | 4,255 | 32,729 |

| 2029 | 21,950 | 5,417 | 27,367 |

| 2030 | 17,451 | 6,720 | 24,171 |

| 2031 | 11,053 | 7,066 | 18,119 |

| 2032 | 7,156 | 7,124 | 14,280 |

Source: Evaluate, a Norstella company

That same year, Keytruda Qlex is expected to sneak up on those sales, hitting more than $7 billion after a slow and steady rise from this year’s launch. While the total for the two versions likely won’t match the original’s massive peak at that point, proceeds from the subcutaneous shot will soften the blow for Merck, said Alicia Heesen, advisory services consultant at Managed Markets Insight and Technology.

“This is an obvious game changer,” Heesen said. “When you see a pretty sharp decline in 2028 and 2029 alongside Qlex, it doesn’t even look like a sharp decline anymore — this will extend their market share and increase potential revenue over the next five years post-loss of exclusivity.”

On top of sales potential and a needed boost for Merck’s future, the shot is a “significant improvement for patients,” said Dr. Cathy Pietanza, vice president of global clinical development at Merck Research Laboratories.

“I’ve seen patients wait long hours in the infusion clinic or days for an appointment,” Pietanza said. “Keytruda Qlex provides a big advancement in cancer care because it gives patients their time back and it decreases the burden on the healthcare system.”

A yearslong journey

When Keytruda was first approved for melanoma in 2014, the patent cliff seemed far in the distance. The ensuing approvals for dozens of new indications have since made the drug a force to be reckoned with across tumor types.

Merck’s effort to develop a subcutaneous version of the cancer treatment began before Pietanza joined the company in 2019. While results ultimately showed the pharmacokinetic availability of the drug, Merck had something else in mind to make Qlex even better.

Merck partnered with South Korea’s Alteogen in 2020, securing access to the delivery technology hyaluronidase, an enzyme designed to allow large-volume subcutaneous administration of biologic drugs like Keytruda. The new technology, tailored to the more specific enzyme berahyaluronidase alfa-pmph, gave Merck the option to administer the injection every three or six weeks with one vial per dose rather than two pre-filled syringes, Pietanza said.

Bristol Myers Squibb’s Opdivo Qvantig and Genentech’s Tecentriq Hybreza, both fellow immunotherapies that target the PD-(L)1 pathway, have also received subcutaneous approvals. But Keytruda Qlex is likely to have the biggest footprint due to the outsized success of its original concoction.

With subcutaneous Keytruda on the market, patients and their physicians have a more accessible route, Pietanza said.

“Drug development is long and challenging, but this will improve patients’ lives,” Pietanza said. “It frees patients from being tethered to an IV line, or frees them from getting an implanted port, which can be disfiguring, and it allows them the opportunity to receive care outside an infusion center.”

The goal of Merck’s phase 3 pivotal trial for Keytruda Qlex was non-inferiority to the original version of the drug, and the subcutaneous shot had a 45% overall response rate in non-small cell lung cancer while the original Keytruda showed 42%.

The study was accompanied by a “switching trial” designed to determine patient preference, where patients began with one version or the other, switched halfway, and then afterward chose which version to continue, said Dr. J. Thaddeus Beck, oncologist and medical director of the Highlands Oncology clinical trials office in Arkansas.

Patients preferred subcutaneous, Beck said. And while Qlex will significantly alter the patient experience, it’s also changing the physical layout of Highlands’ infusion center, he said.

“We’re remodeling offices and changing the way we design and approach new construction to create a whole section specifically for subcutaneous administration,” Beck said. “Sort of a fast track part of the infusion center.”

The payer factor

Merck expects about 30% to 40% of patients to make the switch from IV to subcutaneous based on patient profiles and availability, Heesen said. That’s because about 60% to 70% of Keytruda patients use Keytruda in combination with another IV drug, which would make the transition unnecessary, she added.

But that’s enough to draw patients into a regimen with just one or two minutes of therapy, making them unlikely to want to go back to a 30-minute IV made available by biosimilars. The switch is sensible for payers, as well, Heesen said.

“Payers aren’t going to want to start paying hospitals for the chair time when a minutes-long regimen is available,” she said.

Merck has said it will price Qlex at parity with Keytruda, which is listed at about $12,000 for a 3-week course.

And a report provided via email by MMIT found that a quarter of payers “are likely to prefer the new subcutaneous version over the existing IV version due to its cost efficiency, ease of use and variety in site of care options.”