Johnson & Johnson has been on a tear over the last few years, shedding major business units and rebranding as a slimmer, pharma-focused machine.

Once a highly diversified healthcare giant, J&J leaders have taken the company in a different direction, starting in 2023 by selling off its consumer unit, now called Kenvue. The cash picked up in the deal would help support innovation in pharma and medtech, leaders said at the time.

But they weren’t done slashing yet.

J&J on Tuesday announced it’s sending another business arm out into the open ocean, this time the orthopedics unit, which will operate under the name DePuy Synthes following a separation period of as many as two years. The business, which brought in sales of about $9.2 billion last year, includes hip and knee replacements, as well as devices for trauma and spine health.

That leaves J&J still with a sizable coffer that’s more dedicated to pharmaceutical R&D — which would in turn become an even greater percentage of the company’s revenue base — alongside its medtech pillars in cardiovascular, surgery and vision.

What will a leaner J&J mean for its three priority pharmaceutical areas of oncology, immunology and neuroscience?

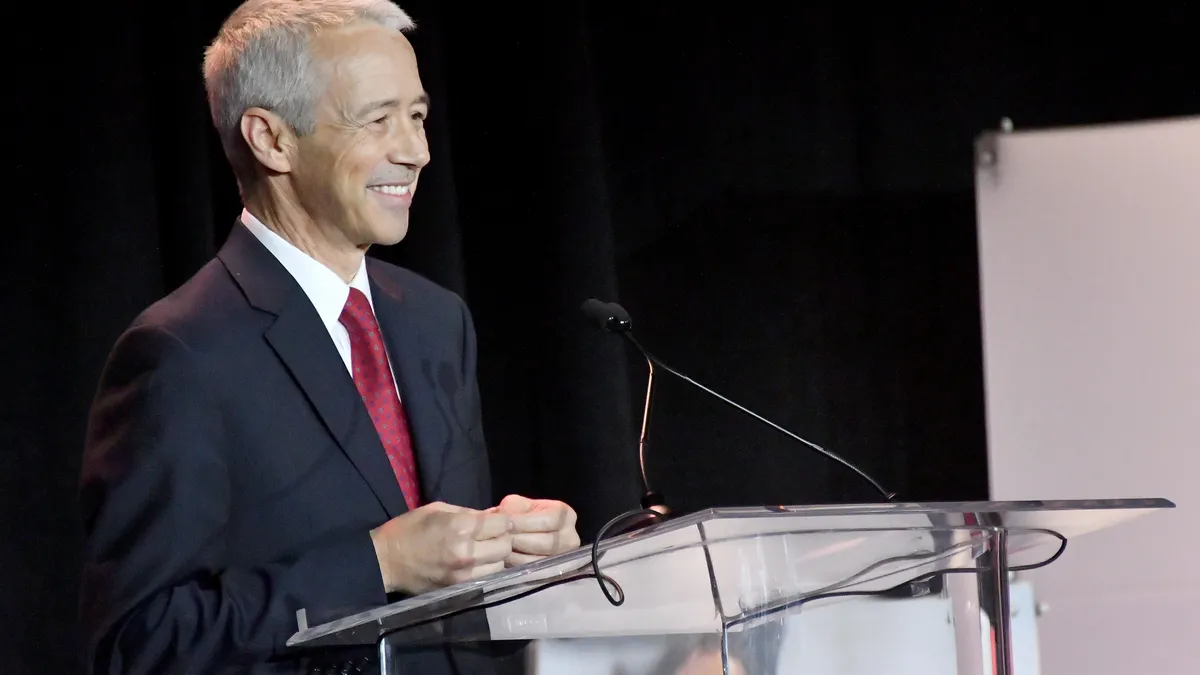

CEO Joaquin Duato said on Tuesday’s earnings call that the changes put the company “in a new era of accelerated growth,” adding: “It’s been a hallmark of Johnson & Johnson to be a good steward of our capital and to make decisions in our portfolio to prioritize where we think breakthrough innovation can come through. That’s exactly what we are doing.”

Oncology momentum

Cancer treatments remain J&J’s biggest sales driver worldwide, raking in $18.5 billion in the first three quarters of the year. Leading the charge is the multiple myeloma powerhouse Darzalex, which boasts more than 50% share of a large market, Duato said on the call.

And with more than 20% growth operationally in the quarter, Darzalex is picking up some of the slack left by faltering sales of AbbVie-partnered Imbruvica, still a blockbuster in its own right but quickly losing ground to blood cancer competition like BeOne’s Brukinsa and AstraZeneca’s Calquence. In the third quarter, Imbruvica’s reported sales fell more than 18% in the U.S.

But one of J&J’s newest rising stars is the CAR-T cell therapy Carvykti, also for multiple myeloma. While cell therapies have generally been hindered by difficult manufacturing and long wait times for patients, Carvykti has consistently eked out a position in the market and this year is showing major growth in sales.

First approved in 2022, Duato said Carvykti has now been used in more than 8,500 patients around the world, and called it “the most successful CAR-T launch ever.” Sales growth of nearly 90% compared to the first three quarters of last year keeps intact an ambitious $5 billion peak annual sales estimate.

Another product with that $5 billion peak sales distinction is Inlexzo, Duato pointed out, which gained approval last month for bladder cancer. Emerging from the 2019 acquisition of Taris Biomedical, the drug-device combo showcases J&J’s ongoing commitment to pharmaceutical and medtech innovation and plays to the company’s overall strengths .

Uphill battle in immunology

Looking across J&J’s wide-ranging portfolio, immunology is a particular challenge for the company in 2025. Why? The megablockbuster Stelara, facing biosimilar competition this year, is sinking like a stone.

Still, Duato assured investors the situation is under control.

“Some were not convinced we could grow through the loss of exclusivity of Stelara, but we were confident, and we have now unequivocally answered that question,” Duato said.

Stelara pulled in global sales of $4.9 billion in the first three quarters of the year, which retains its spot as J&J’s bestselling immunology asset, but that’s down from more than $8 billion this time last year. However, what the company is losing from one blockbuster, it’s picking up quickly from another.

Tremfya, first approved in 2017, is quickly taking that mantle from Stelara, and J&J’s leaders are happy to witness the regime change. In the first three quarters, Tremfya raked in nearly $3.6 billion worldwide, a rise of more than 30% from the same period last year.

“We have long talked about Tremfya as the next big innovation to follow the success of Stelara,” Duato said. “Based on this quarter’s performance, it looks like it could be both bigger and better.”

While Stelara peaked with sales of around $11 billion in 2023, Duato said the C-suite is “confident Tremfya will become a more than $10 billion asset.”

And of course, J&J also has an R&D machine in immunology to build on today’s blockbusters, with the plaque psoriasis pill icatrekibart submitted to the FDA for approval this past summer.

Neuroscience nascency

J&J’s presence in neuroscience isn’t as established as it is in immunology and oncology, but that’s changing.

Sales of the ketamine-based depression treatment Spravato shot up more than 60% worldwide over the same quarter last year, reaching $459 million. For the year to date, sales have already surpassed $1 billion, and Duato said the drug has been used in more than 180,000 patients.

J&J is also banking on Caplyta, an asset obtained in the acquisition of Intra-Cellular Therapies in April, one of the biggest pharma deals of the year at $14.6 billion. Already approved for schizophrenia and episodes of bipolar disorder, J&J expects an upcoming nod for major depressive disorder, which could drive sales of $5 billion a year, Duato said.