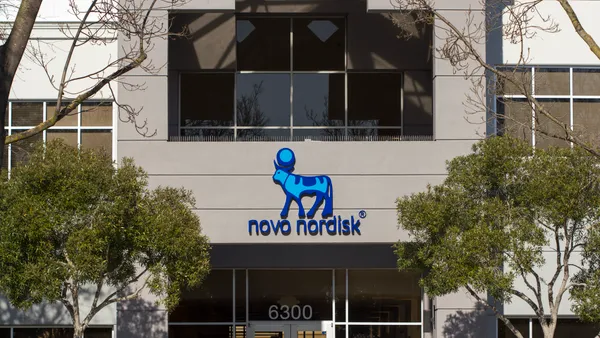

To keep up with intense demand for its GLP-1 drugs Wegovy and Ozempic, Danish drug maker Novo Nordisk has brokered an uncommon deal with Catalent, a New Jersey-based contract manufacturer, which has at least one competitor and a regulator on alert.

Under the terms of the deal, Novo’s controlling shareholder, Novo Holdings, will buy Catalent for $16.5 billion. The deal includes 50 sites that produce small molecules, biologics, and cell and gene therapies. As part of the deal, Novo will control of three of Catalent’s manufacturing plants, which it already works with in Italy, Belgium and Indiana, to ramp up production of its GLP-1 weight loss and type 2 diabetes drugs — a drug category some experts say has the potential to become a $200 billion industry by 2030.

But since the announcement earlier this month, questions have swirled around how the deal will affect Catalent’s operations, whether it raises potential antitrust issues, or if it will signal the start of an industry trend.

Here are three major questions hanging over the Novo-Catalent deal.

Will it upend Catalent’s business model or the drug supply?

“In general, pharma companies have relied on contract organizations for certain research, developing and manufacturing activities but this level of need on the part of GLP-1 and GIP manufacturers is of a new order, and it is not surprising that the major manufacturers are scrambling for capacity,” said Dr. Howard Forman, a professor at Yale School of Management and Yale School of Public Health.

While the move may make business sense, it still has to be approved by company shareholders and regulators, and is not without controversy.

“In a time of lean production and shareholder expectations of ever more efficient processes, this may be an unusual one-off."

Dr. Howard Forman

Professor, Yale School of Management, Yale School of Public Health

One issue is whether it will impact Catalent’s existing contracts with other customers. Novo pledged to honor all customer obligations at the three sites it’s acquiring as it works to close the deal toward the end of 2024. The company also indicated the deal will help ensure customers have access to its products.

“The acquisition of the filling sites is aligned with Novo Nordisk’s strategy of reaching more people living with diabetes and obesity with current and future treatments,” company officials said in a press release. “It enables an expansion of the manufacturing capacity at scale and speed while providing future optionality and flexibility for Novo Nordisk’s existing supply network. The acquisition is expected to gradually increase Novo Nordisk's filling capacity from 2026 and onwards.”

But taking over manufacturing may bring new headaches. The Indiana plant Novo will purchase was hit recently with an FDA Form 483 after inspectors uncovered manufacturing problems. While Novoy is confident the acquisition and its other initiatives will boost manufacturing capacity, Forman said he sees it as more of a gamble.

“I am interested to see what is done with the remainder of Catalent: Will it be spun off? Will it be revamped? Will Novo be able to convert production quickly and prove brilliant; or will this turn out to be a short-term solution that is a long-term burden?” he wondered.

What does the deal mean for Eli Lilly?

Eli Lilly, maker of competing GLP-1 drugs, Mounjaro and Zepbound, has also been trying to boost its manufacturing capabilities, building a $2.5 billion manufacturing site in Germany and adding on to existing facilities. But Lilly CEO David Ricks went on the record calling the Catalent deal “unusual.” Other company executives have expressed concern about its implications for Lily’s manufacturing contract with Catalent to produce its highly sought after drugs.

“Catalent is an integral part of manufacturing commercial and pipeline products for the industry, especially in diabetes and obesity, and we have products with these sites as well,” Lilly Chief Financial Officer Anat Ashkenazi said on a conference call with analysts, according to the Wall Street Journal. “Our focus today is on ensuring continuity of supply of medicine for patients is uninterrupted, as well as, we intend on holding Catalent accountable to their contracts with us.”

Ricks said the agreement might warrant additional scrutiny from antitrust regulators. The European Medicines Agency has already said it will take a look at the buy to see if it has any implications for drug availability among Catalent-manufactured medications.

Will this deal spark a new trend in pharma?

It's not clear whether the Novo-Catalent matchup has implications for other pharma companies, but analysts are skeptical it will trigger a new wave of similar deals.

“In a time of lean production and shareholder expectations of ever more efficient processes, this may be an unusual one-off,” Forman said.

For now, it’s still far more common for companies to get out of the manufacturing business by outsourcing to a contract organization.

“Novo-Catalent is certainly a unique scenario, and I’m hard-pressed to imagine a similar take-out happening with the remaining CDMOs in the field,” Gil Roth, president, Pharma & Biopharma Outsourcing Association, told GlobalData PharmSource.